2020 W-2s: Failing to plan is planning to fail

You can’t afford to botch W-2s with a late roll out of your year-end plan. This year will be even more challenging and you don’t have to guess why. Here’s what you need to consider.

Getting started

Conventional wisdom is to set up a year-end committee with your departmental peers so everyone knows what to expect from whom and by when.

Working remotely will in all likelihood throw a monkey wrench into gathering and dispersing necessary data. So now is the time to schedule a Zoom or Google Meet event with Benefits, IT, Accounts Payable and Finance.

W-2 Reporting requirements

You will be able to truncate employees’ SSNs on all W-2 copies, except Copy A, which is filed with the Social Security Administration.

Which is great, as far as it goes. States, however, don’t seem to be on board with the all-copies-except-Copy A thing. So it’s very likely you’ll need to report full Social Security numbers on at least W-2, Copy 1. To find out if your state allows SSN truncation on Copy 1, visit your state tax department’s website.

We wrote about reporting employees’ pandemic-related paid sick leave in Box 14 back in July.

Some payroll pros are now worried the Social Security Administration’s computers will spit out these W-2s as incorrect, because employees’ paid sick/family leave is subject to the employee’s portion of FICA, but not the employer’s portion.

That shouldn’t happen. Box 14 reporting is informational and required only because employees who are eligible for pandemic-related tax credits in their own right due to side gigs must subtract their employer-provided paid leave.

Providing W-2 forms to employees

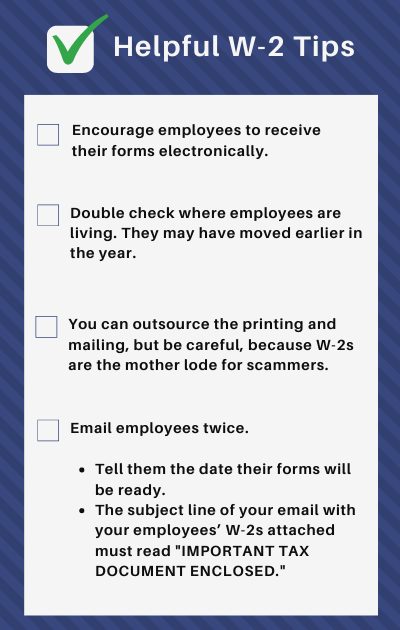

You don’t normally think twice about this, but this isn’t a normal year. Tip: Double check where employees are living. They may have moved earlier in the year.

Payroll departments working remotely may not have access to printers to print employees’ W-2s. You can outsource the printing and mailing of your W-2s, but be careful when contracting with a third party, because W-2s are the mother lode for phishers and scammers. You need to ensure proper security measures are included in the contract.

A better idea is to encourage employees to receive their forms electronically. You may already post employees’ W-2s to your employee self-service portal, but such posting doesn’t count for electronic delivery.

Furnishing W-2s electronically requires a specific procedure and it’s best to get started now, so you have ample time to follow up with employees.

To furnish W-2s electronically, you must disclose the following information and provide a clear and conspicuous statement of each requirement to employees:

- Employees must be informed they’ll receive paper W-2s if they don’t consent to electronic delivery.

- Employees must be informed of the scope and duration of their consent (e.g., are they consenting for this year’s W-2s only or for all future years).

- Employees must be informed of the procedure for obtaining paper copies and whether you’ll treat a request for paper W-2s as a withdrawal of their consent to receive W-2s electronically.

- Employees must be notified about how to withdraw their consent and the effective date and manner by which you will confirm their withdrawn consent; employees must be notified that their withdrawn consent doesn’t apply to the previously issued W-2s.

- Employees must be informed about any conditions under which electronic W-2s won’t be furnished (e.g., their employment terminates).

- Employees must be informed of any procedures for updating their contact information that enables you to provide electronic W-2s.

- You must notify employees of any changes to the employer’s contact information.

- You must notify the employee of all hardware and software requirements to receive their forms electronically.

When the time comes, email employees twice. First tell them the date their forms will be ready. Second, the subject line of your email with employees’ W-2s attached must read IMPORTANT TAX DOCUMENT ENCLOSED.

And this is key. Phishers will seek to scam employees with similar email subject lines, like Your W-2s are ready. Reiterate to employees that emails without the IMPORTANT TAX DOCUMENT ENCLOSED subject line are spam and they should alert you immediately.