When are 1099 forms due? And more important dates to remember

Updated: 11/30/2020

Despite the burdensome W-2 year-end process, it’s important not to forget when 1099s are due. Otherwise, you could face penalties from the IRS.

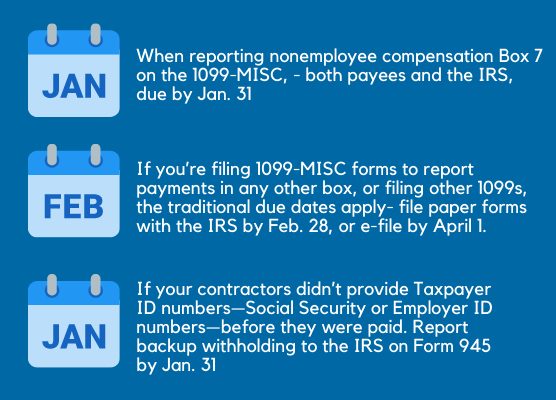

If you’re reporting nonemployee compensation in Box 7 of Form 1099-MISC, these 1099s are due to both payees and the IRS, by Jan. 31, 2019. This due date applies regardless of whether you file on paper or electronically.

If you’re filing 1099-MISC forms to report payments in any other box, or you’re filing other 1099s, the traditional due dates apply—provide payees with their copies by Jan. 31, 2019 (Feb. 15, 2019, if you’re reporting gross proceeds to any attorney); file paper forms with the IRS by Feb. 28, or e-file by April 1.

Forms may be provided to recipients electronically, if they consent.

If contractors didn’t give you their Taxpayer Identification numbers—Social Security or Employer Identification numbers—before they were paid, or you’re withholding under the IRS’ B notice program, you should have been backup withholding on their payments. Report backup withholding to the IRS on Form 945 by Jan. 31, 2019.

Who gets Form 1099-MISC?

Independent contractors must receive 1099-MISC forms if they do business in noncorporate forms—sole proprietorships, partnerships, disregarded entities, or limited liability companies that don’t elect to be treated as corporations—and you’ve paid them at least $600 in cash for services they provided to your business. Attorneys who do business as corporations must also receive forms.

Don’t overlook these potential recipients:

- Inside and outside corporate directors

- Outside accountants, lawyers, and salespeople

- Auto mechanics/service stations that repair company cars

- Plumbers, electricians, painters, carpenters, tech consultants, or office cleaners

- Equipment lessors and repair people

- Office/company car lessors.

TIN matching

The easiest way to stave off penalties for name/TIN mismatches is to use the IRS’ online TIN matching program before completing 1099-MISC forms. You may verify up to 25 name/TIN combos on the screen. Hitch: You must register with the IRS to use this program. More information on TIN matching is available at tinyurl.com/irstins.

TIN truncation

You may truncate the first five digits of a payee’s TIN on their paper or electronic copies; forms filed with the IRS must contain the full TIN. These TTINs, as they’re called, look like this: XXX-XX-1234 or ***-**-1234 for SSNs, or XX-XXX1234 or **-***1234 for EINs. Warning: You can’t truncate your own EIN.

How to file

If you file 250 or more 1099-MISC forms, you must e-file through the IRS’ FIRE system. However, if this is the first year you’ll be e-filing, you must file Form 4419 at least 45 days before the due date of the returns to allow the IRS time to process and respond to your application. In addition, consider checking your FIRE password; passwords must be 8-20 characters long and contain at least one uppercase character, lowercase character, at least one number, and one symbol.

Think about Inc.

The words “Corporation,” “Corp.,” “Incorporated” or “Inc.” on service providers’ letterheads, business cards, or invoices mean they’re corporations, so no 1099-MISC reporting is necessary. However, if “Company” or “LLC” is used, you’re not automatically off the 1099 hook. Further inquiry into the contractor’s business structure is necessary. You can’t go wrong sending out more 1099s than are required, but you set yourself up for penalties by sending out fewer.

Other key tasks for January 31

In addition to 1099s, make sure these are on your agenda to complete by January 31.

Give:

- Employees their copies of Form W-2 for 2018

- Retirees their copies of Form 1099-R

File:

- Forms W-2 with the Social Security Administration.

- Form 940 for 2018. If the undeposited FUTA tax is $500 or less, you can pay it with your return or deposit it. It must be deposited if it’s more than $500. If you deposited the tax for the year in full and on time, you have until Feb. 11 to file the return.

- Form 945 to report income tax withheld in 2018 from nonpayroll items, including backup withholding and withholding on pensions and annuities.

If you file quarterly, file Form 941 for the fourth quarter of 2018. Deposit any undeposited tax. If the total is less than $2,500 and not a shortfall, you can pay it with the return. If you deposited the tax for the quarter in full and on time, you have until Feb. 11 to file the return.

Annual filer? file Form 944 for 2018. Deposit any undeposited tax. If the total is less than $2,500 and not a shortfall, you can pay it with the return. If you deposited the tax for the year in full and on time you have until Feb. 11 to file the return.

Insurance Forms

Large insured employers provide full-time employees with Form 1095-C; large self-insured employers provide every employee enrolled in coverage with Form 1095-C. Small self-insured employers provide every employee enrolled in coverage with Form 1095-B.

Employers with incentive stock option plans provide employees with Form 3921; employers with employee stock purchase plans provide employees with Form 3922.

Editor’s Notes:

For current information on 1099s, see these articles: